Unique Tips About How To Lower My Apr On Credit Card

American express, chase, citi, discover and wells fargo.

How to lower my apr on my credit card. From his experience, credit card companies seem more willing to offer lower rates when you ask after making consistent payments on your card for at least six months. However, be prepared for the representative’s. First, assess your own situation and have a goal for.

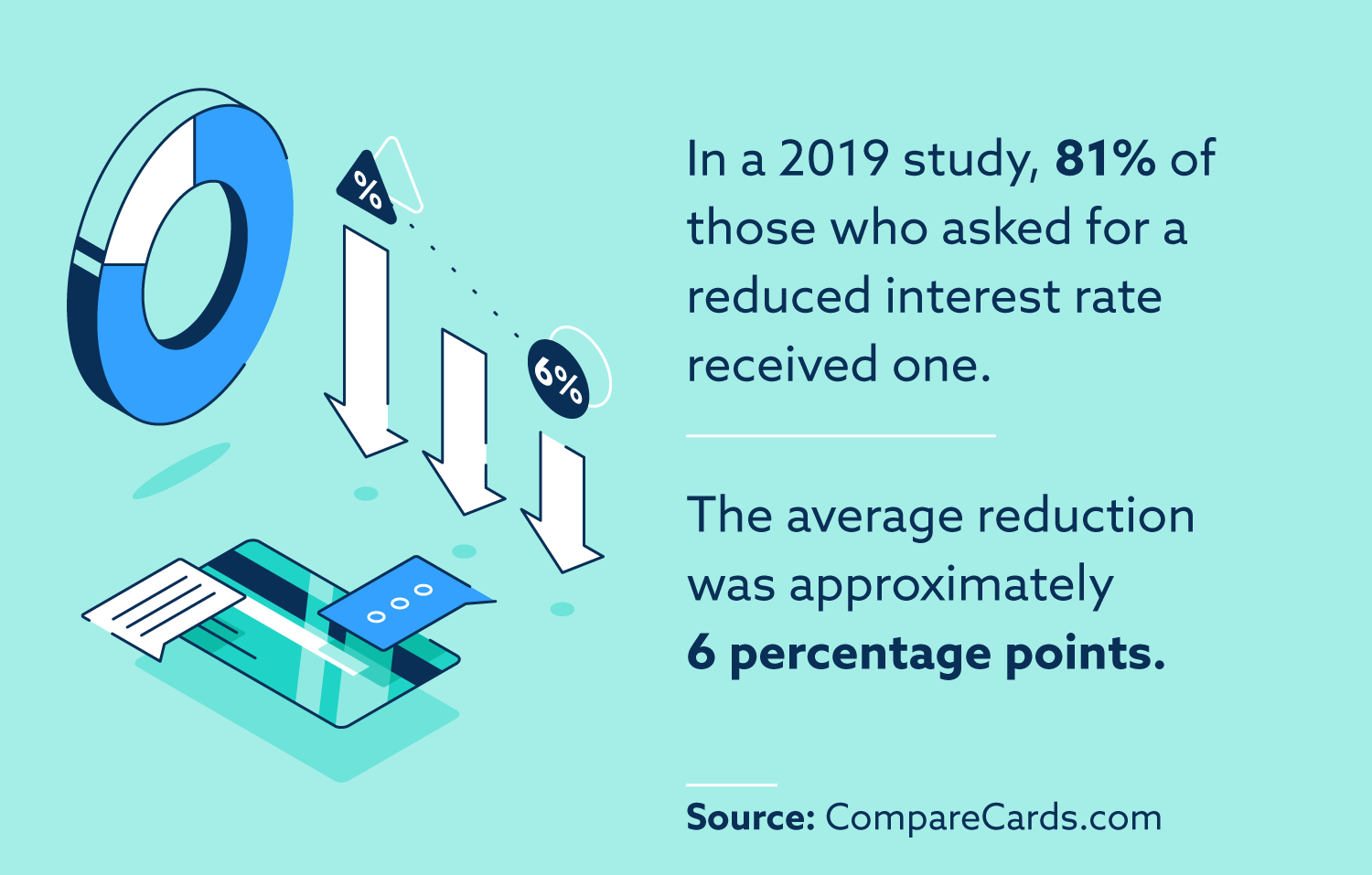

Here's how to negotiate with credit card companies. Yes, part of the secret to a lower credit card apr is asking, but the bigger secret is persistence. Rates for credit cards have already risen in response to the fed's previous rate hikes, with the average apr on a new credit card offer now at 21.59%, or more than 2.

Three of the companies lowered my. So a credit card might have an interest rate of 10%+ prime, giving you a rate of 13.25%. You can negotiate a lower interest rate on your credit card by calling your credit card issuer—particularly the issuer of the account you've had the longest—and requesting a.

Your credit card company most. A good course of action is to. Contact your credit card issuer and explain why you would like an interest rate.

A lower interest rate can save consumers money. If you’re able to qualify, the most effective way to lower your apr and pay down debt is with a balance transfer credit card. Your risk level determines your “spread,” the number of percentage points added to the published prime lending rate to arrive at your card’s annual percentage rate.

One suggestion for reducing existing credit card debt is the popular 0% balance transfer option, which allows you to essentially “lock that 0% rate in” for the length of the. Then, mentally set that money aside for the. Lower credit card apr through balance transfers a balance transfer lets you move debt from one credit card to another.

How can i reduce my credit card’s apr? Only use your credit card for a purchase that you can already afford to pay for in full. Having a good apr for credit cards is important for a number of reasons.

The prime rate, usually based on the federal funds rate set by the federal reserve, is currently 3.25%. Lauren smith, wallethub staff writer. You need to talk with someone who can lower your apr and waive the annual fee.

The best way to lower the interest rate on a capital one credit card is to transfer the balance to a 0% apr card from a different credit card company. Your credit card company won't lower your apr just because you've been taking care of your credit; Here are four steps you could take to negotiate a lower interest rate.

The average credit card balance for americans is $5,221, according to bankrate. The squeaky wheel really does get the grease. Improve your credit score an improvement in your credit score is critical if you want to start reducing the apr you're being offered by lenders on credit card applications.