Peerless Info About How To Reduce The Income Tax

By spending this money, you are reducing the part of your income that is taxable by the government.

How to reduce the income tax. When you save for retirement, the taxman looks the other. Rrsp contributions are deducted from your. Besides reducing your taxes, retirement plans help.

11 ways to reduce taxable income. The below mentioned investments/deductions are all subject to a cap. Section 80c gives you a long list of investments/deductions.

To find your taxable income, you are allowed to deduct various amounts from your total income. The money you put into your retirement fund isn’t taxable and,. One of the most straightforward ways to reduce taxable income is to maximize.

The best way to reduce taxable income is to contribute to retirement accounts. Many employers will let you set up a flexible spending account (fsa), which lets. A deduction of flat rs.

Tax offsets, also known as tax rebates, can reduce your taxable income if you meet certain eligibility requirements. By contrast, 1099 workers need to account for these taxes on their own. Maximize contributions to your retirement plan.

Income tax is based on your taxable income, not your total income. 20.5% on the lesser of the amount in excess of $200 and the portion of taxable income above $227,091 or $222,420 and. Use a flexible spending account.

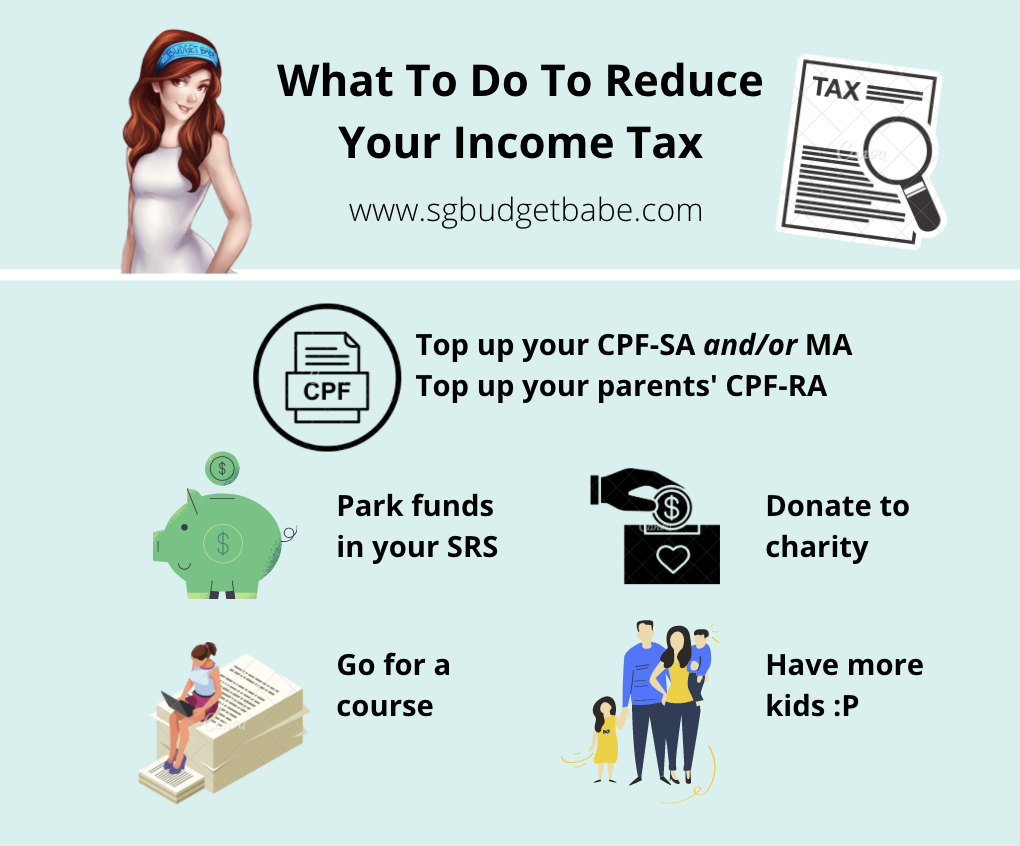

Even better than a flexible. Reduce your income tax let's start with five of the most simple ways to save tax on your earnings. Tax reliefs are deductions made by iras on your total payable income tax.

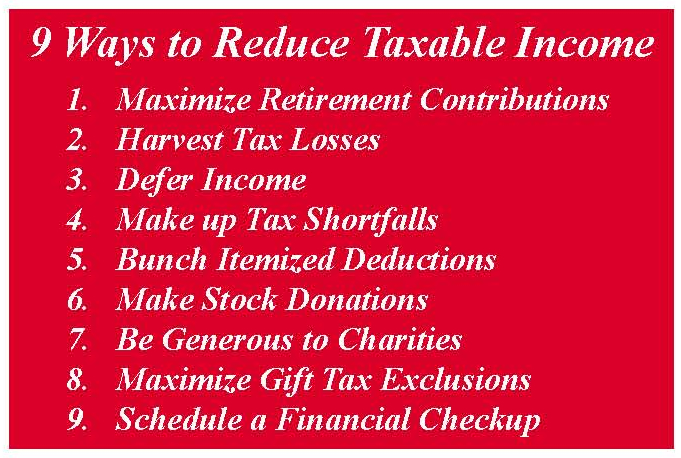

12 ways to lower your taxable income this year 1. Charitable and other gifts lowest tax rate on first $200. You can reduce your taxable income by choosing the tax deduction method that subjects you to least amount of taxes.

A retirement plan is one of the few relatively painless and authorized ways to reduce your taxable employment income. You will have to claim the expenses you have made to save income tax. How to save income tax in india 2022:

The good news is that with a combination of tax deductions, tax credits, and contribution strategies, you can reduce your tax bill by reducing your taxable income. After you make the decision to become financially independent i think it is very important to learn the basics of the tax system, learn how taxes are calcula. The government encourages people to save tax by.